$2000 worth Free Value Added Services

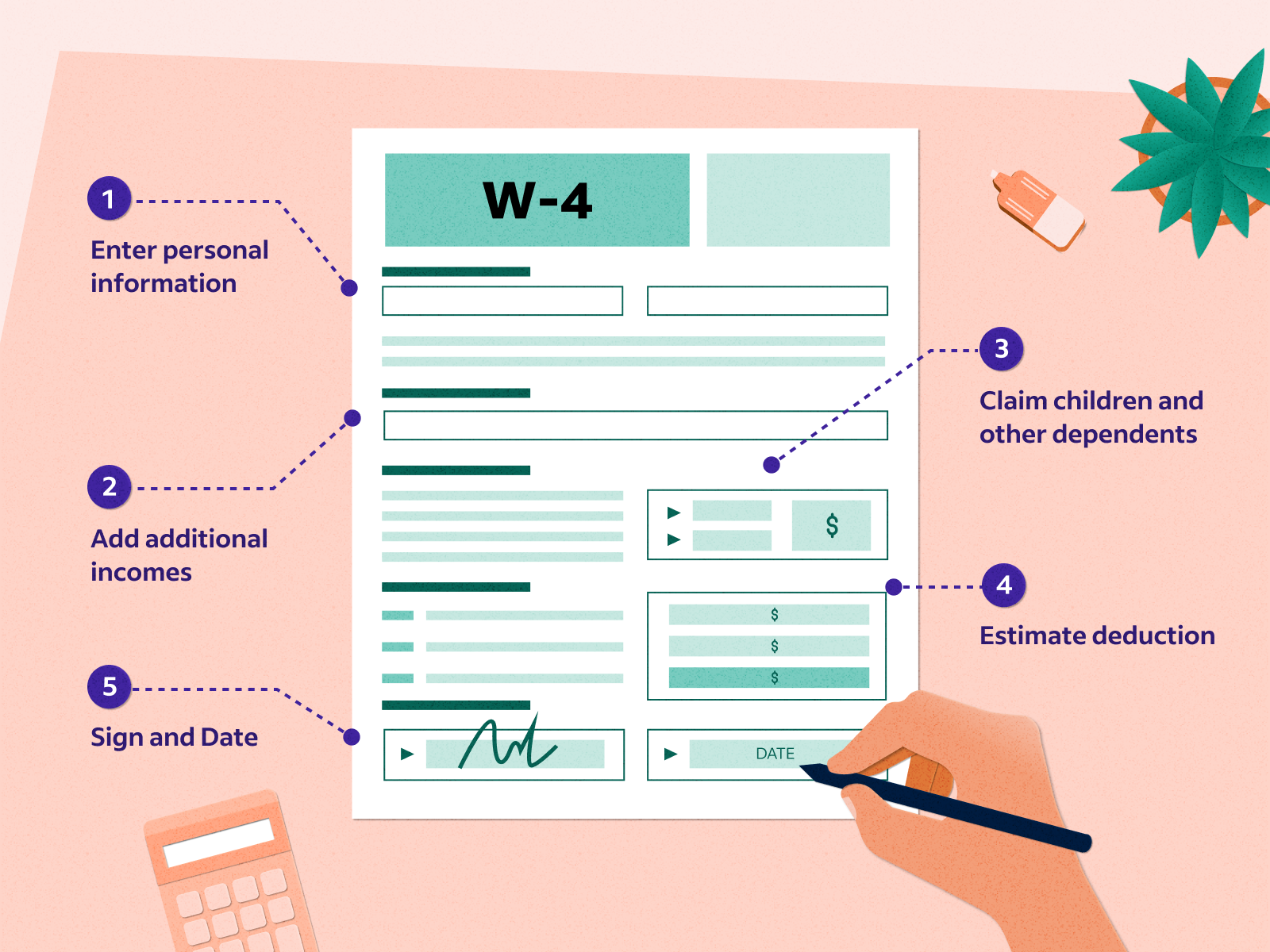

W4 Guidance & Assistance

Each year, the Internal Revenue Service issues a new W-4, and each year, many people don’t bother to fill it out.Incomplete information on ..

ITIN Guidance and support

We have been noticing that most of the resident aliens tax payers who are on H1, L1, and GC having dependents in foreign countries, are missing the dependent tax benefits and credits due to lack of tax knowledge..

FICA Taxes withdrawal guidance

These taxes, which are split evenly between employers and employees, cover Social Security and Medicare. Old Age, Survivors, and Disability Insurance, or OASDI, is the name given to the portion of Social Security..

Accurate tax estimate

The accurate tax estimates that we provide Tax summaries are tax returns generated by a senior tax analyst, with the first review done by Enrolled agents (EA) and the final review done by our CPA...

FBAR guidance and support

While filing US tax returns is well-known,do you know FBAR Filing? FBAR stands for “Foreign Bank Account Report”, and you’ll use the FinCEN 114 form to file it. What’s the big deal, you ask? Well, failing to file the FBAR...

Tax expert support for audits

We have observed that the majority of taxpayers are receiving notices, audits, or inquiries from the IRS and state income tax departments asking them to pay penalties and interest on filed tax returns...